The Strategy Snapshot

WHERE ARE YOU NOW?

ARE YOU...

- Starting to think about retirement, but unsure where to begin?

- Managing your investments, but unsure that your current asset allocation meets with your risk tolerance or overall “view of the world”.

- Already retired and interested in principal preservation, guaranteed income and stability for the “safer” part of your portfolio.

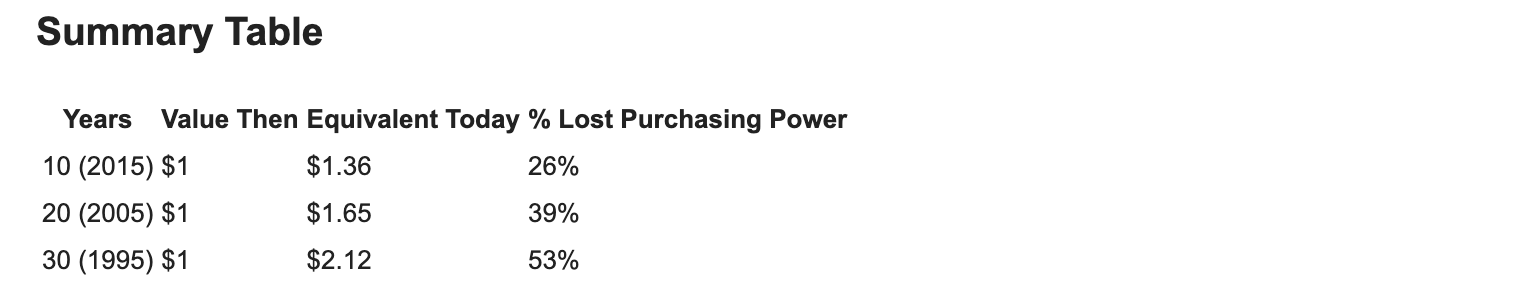

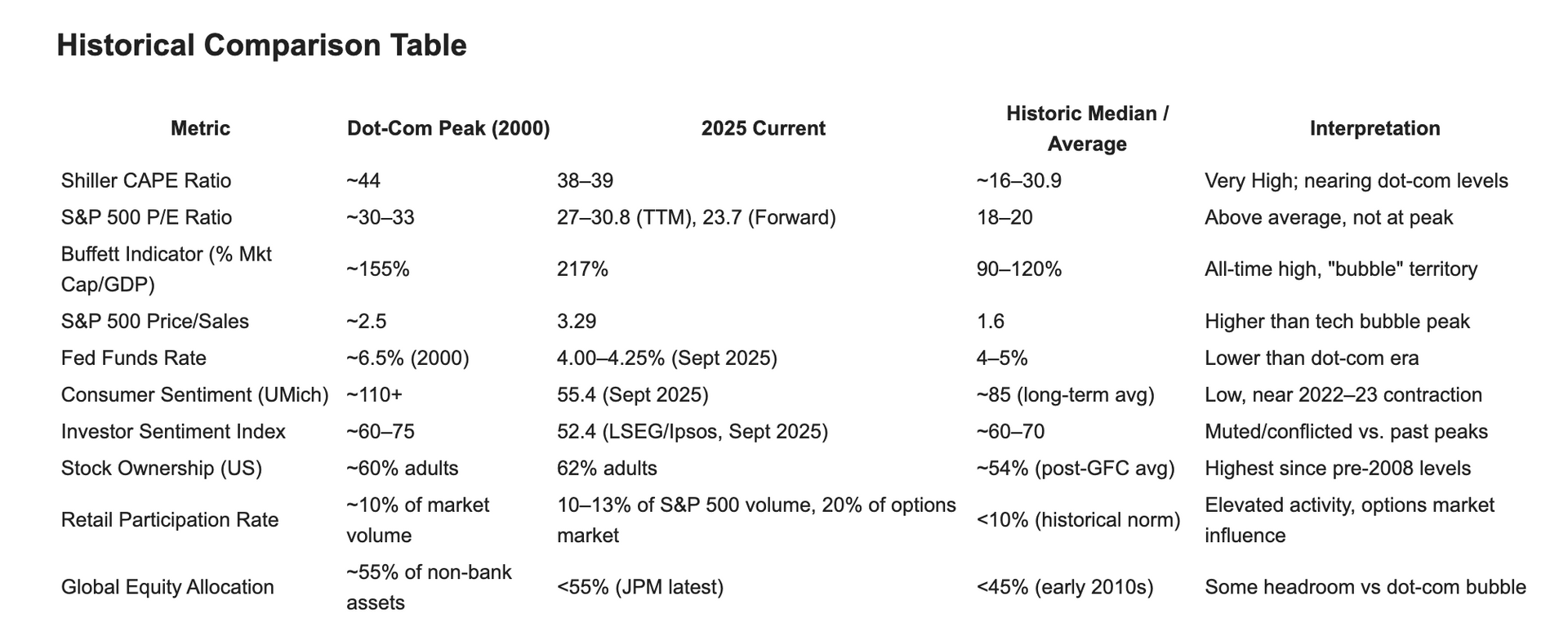

- Aware of how “sequence of returns” affects your long term distribution strategy, especially in today’s richly valued equity market and above average 5 year recent returns.

- Mindful of the long term impact that rising inflation and volatile interest rates have on the bond portion of your portfolio.

- Are you already rich and would prefer ideas how to help others and increase your social network? Ask about our proprietary "Money Match" program.

WE MEET YOU WHERE YOU ARE.

Explore tailored, “financial science” based strategies based on your life stage, longevity expectation and risk tolerance.

THE CONSULTANT DIFFERENCE

An unpaid second opinion is simply a sales call.

At incomes and legacies, our fee-based consultants never earn commissions or receive assets under management (AUM) fees. While the company may, in certain circumstances, receive a finder’s fee from the issuing company, your consultant personally never does. We never take control of your assets, but if you hire us, we’ll help YOU take control.

After all, it’s YOUR money!

OUR Consultant-Based FOCUS AREAS:

ETF

Education

We help you understand and use low-cost, diversified ETFs to build a smarter, more transparent investment portfolio, including sectors like gold, bitcoin, semiconductors, software, biotech, AI, new energy, etc...

Retirement Income Planning

We design personalized strategies to convert a portion of your savings into steady, sustainable income throughout retirement.

Long-Term Care Solutions

We help you prepare for healthcare needs later in life with options that protect your assets and preserve your independence.

Legacy

Design

We guide you in creating a clear, tax-efficient plan to pass on your wealth and values to those you love.

The Real Challenge

Do these sound familiar?

We're helping independent, resourceful young Boomers and older Gen Xers bridge the gap between what they have and what they need to feel secure. You don't need a pension to build a plan; you just need a partner.

mEMORIES & MONEY

wHAT wILL yOU lEAVE bEHIND?

Your legacy is more than numbers. It's confidence, clarity, and care for the people you love.

We will help you understand your options regarding:

Wills, Trusts, Powers of Attorney

Wills, Trusts, Powers of AttorneyInsurance and Long-Term Care Strategy

Proper planning can help you save money and reduce liabilities.

Income Planning for Life, and for Your Spouse

Income Planning for Life, and for Your SpouseWealth Transfer that Aligns With Your Values

Wealth Transfer that Aligns With Your ValuesReady to think like

an investor?

📈 Bullish or bearish?

📉 Overvalued or underappreciated?

Here, we don't just follow the headlines — we dissect them.

"I have known Tom for over a decade. He reached out to me after my wife passed and I appreciate his consultative and comprehensive approach. I look forward to continuing to use Tom as my financial sounding board. "

Richard H.

Leesburg, VA

"We have known Tom since before the financial crisis while he was at Navy Federal. He helped us make money thru our investments and then preserve our capital when we no longer wanted to worry about the stock market. He even came to our house and met with our son. Thanks Tom."

Jerry & Bobby M.

Haymarket, VA

"I'm a lawyer and I understand contracts. I wanted to find a bond alternative for a portion of my fixed income portfolio that was immune from interest rate volatility. Tom helped me find a suitable maturity date paired with a competitive interest rate."

Mark H

Charlotte, NC